How Do Interest Rates Affect Long Term Bonds . Bonds have an inverse relationship with interest rates: If rates move up by 1 percentage point, the price of a bond with a duration of 5.0 years will move down. Monetary policy — specifically, actions by the fed to tame inflation or. bond prices move in inverse fashion to interest rates, reflecting an important bond investing consideration known as interest rate risk. how interest rates impact your bond investments. The impact, however, will vary according to each investor's individual circumstances. interest rate risk is the risk of changes in a bond's price due to changes in prevailing interest rates. here’s very simplified version of how it works: When interest rates rise, bond prices generally fall. when interest rates rise, bond values decrease. When rates rise, the price of existing bonds. how lower rates impact bond investors. the effect of interest rates on bonds can be summarized as follows: If bond yields decline, the.

from jonluskin.com

If bond yields decline, the. When rates rise, the price of existing bonds. interest rate risk is the risk of changes in a bond's price due to changes in prevailing interest rates. Monetary policy — specifically, actions by the fed to tame inflation or. how interest rates impact your bond investments. here’s very simplified version of how it works: when interest rates rise, bond values decrease. If rates move up by 1 percentage point, the price of a bond with a duration of 5.0 years will move down. The impact, however, will vary according to each investor's individual circumstances. Bonds have an inverse relationship with interest rates:

Are LongTerm Treasury Bonds Worth Holding? II Jon Luskin, CFP® • Hourly Advice for DoIt

How Do Interest Rates Affect Long Term Bonds When rates rise, the price of existing bonds. Monetary policy — specifically, actions by the fed to tame inflation or. the effect of interest rates on bonds can be summarized as follows: how interest rates impact your bond investments. When rates rise, the price of existing bonds. Bonds have an inverse relationship with interest rates: interest rate risk is the risk of changes in a bond's price due to changes in prevailing interest rates. If rates move up by 1 percentage point, the price of a bond with a duration of 5.0 years will move down. The impact, however, will vary according to each investor's individual circumstances. when interest rates rise, bond values decrease. When interest rates rise, bond prices generally fall. If bond yields decline, the. here’s very simplified version of how it works: bond prices move in inverse fashion to interest rates, reflecting an important bond investing consideration known as interest rate risk. how lower rates impact bond investors.

From www.financestrategists.com

ShortTerm vs. LongTerm Bonds Overview, Key Factors How Do Interest Rates Affect Long Term Bonds The impact, however, will vary according to each investor's individual circumstances. Monetary policy — specifically, actions by the fed to tame inflation or. If bond yields decline, the. bond prices move in inverse fashion to interest rates, reflecting an important bond investing consideration known as interest rate risk. Bonds have an inverse relationship with interest rates: when interest. How Do Interest Rates Affect Long Term Bonds.

From dxosyfjua.blob.core.windows.net

How Does The Interest Rate Affect Bonds at Hilda Bartlett blog How Do Interest Rates Affect Long Term Bonds Monetary policy — specifically, actions by the fed to tame inflation or. bond prices move in inverse fashion to interest rates, reflecting an important bond investing consideration known as interest rate risk. When rates rise, the price of existing bonds. here’s very simplified version of how it works: When interest rates rise, bond prices generally fall. when. How Do Interest Rates Affect Long Term Bonds.

From financialdesignstudio.com

Managing Interest Rate Risk in your Bond Investments How Do Interest Rates Affect Long Term Bonds Bonds have an inverse relationship with interest rates: how interest rates impact your bond investments. When interest rates rise, bond prices generally fall. The impact, however, will vary according to each investor's individual circumstances. the effect of interest rates on bonds can be summarized as follows: interest rate risk is the risk of changes in a bond's. How Do Interest Rates Affect Long Term Bonds.

From walletinvestor.com

How do interest rate changes affect Bond ETFs? WalletInvestor Magazin Investing news How Do Interest Rates Affect Long Term Bonds here’s very simplified version of how it works: Bonds have an inverse relationship with interest rates: If bond yields decline, the. When interest rates rise, bond prices generally fall. when interest rates rise, bond values decrease. how lower rates impact bond investors. bond prices move in inverse fashion to interest rates, reflecting an important bond investing. How Do Interest Rates Affect Long Term Bonds.

From www.usbank.com

How Do Rising Interest Rates Affect the Stock Market? U.S. Bank How Do Interest Rates Affect Long Term Bonds the effect of interest rates on bonds can be summarized as follows: Monetary policy — specifically, actions by the fed to tame inflation or. If bond yields decline, the. how lower rates impact bond investors. when interest rates rise, bond values decrease. interest rate risk is the risk of changes in a bond's price due to. How Do Interest Rates Affect Long Term Bonds.

From us.etrade.com

Bonds, interest rates, and inflation Learn More E*TRADE How Do Interest Rates Affect Long Term Bonds When rates rise, the price of existing bonds. If bond yields decline, the. Bonds have an inverse relationship with interest rates: When interest rates rise, bond prices generally fall. The impact, however, will vary according to each investor's individual circumstances. interest rate risk is the risk of changes in a bond's price due to changes in prevailing interest rates.. How Do Interest Rates Affect Long Term Bonds.

From www.slideserve.com

PPT Interest Rates and Bond Valuation PowerPoint Presentation, free download ID3075575 How Do Interest Rates Affect Long Term Bonds If rates move up by 1 percentage point, the price of a bond with a duration of 5.0 years will move down. Monetary policy — specifically, actions by the fed to tame inflation or. when interest rates rise, bond values decrease. The impact, however, will vary according to each investor's individual circumstances. how interest rates impact your bond. How Do Interest Rates Affect Long Term Bonds.

From www.investing.com

Bonds And Long Term Rates How Do Interest Rates Affect Long Term Bonds If bond yields decline, the. the effect of interest rates on bonds can be summarized as follows: Bonds have an inverse relationship with interest rates: Monetary policy — specifically, actions by the fed to tame inflation or. The impact, however, will vary according to each investor's individual circumstances. If rates move up by 1 percentage point, the price of. How Do Interest Rates Affect Long Term Bonds.

From www.financestrategists.com

ShortTerm vs. LongTerm Bonds Overview, Key Factors How Do Interest Rates Affect Long Term Bonds how interest rates impact your bond investments. If rates move up by 1 percentage point, the price of a bond with a duration of 5.0 years will move down. here’s very simplified version of how it works: If bond yields decline, the. how lower rates impact bond investors. When interest rates rise, bond prices generally fall. When. How Do Interest Rates Affect Long Term Bonds.

From exoancojc.blob.core.windows.net

How Does Interest Rates Work On I Bonds at Jamie Lewis blog How Do Interest Rates Affect Long Term Bonds how interest rates impact your bond investments. If rates move up by 1 percentage point, the price of a bond with a duration of 5.0 years will move down. here’s very simplified version of how it works: Monetary policy — specifically, actions by the fed to tame inflation or. The impact, however, will vary according to each investor's. How Do Interest Rates Affect Long Term Bonds.

From jonluskin.com

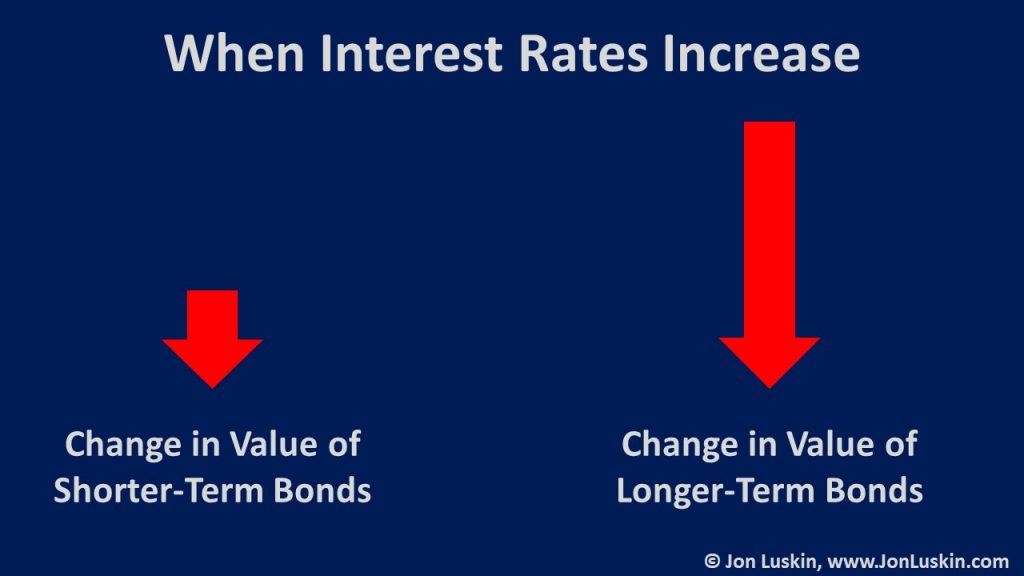

wheninterestratesincreasethevalueoflongertermbondsincreasesmoresothanshorterterm How Do Interest Rates Affect Long Term Bonds here’s very simplified version of how it works: If bond yields decline, the. how interest rates impact your bond investments. If rates move up by 1 percentage point, the price of a bond with a duration of 5.0 years will move down. how lower rates impact bond investors. Bonds have an inverse relationship with interest rates: When. How Do Interest Rates Affect Long Term Bonds.

From www.researchgate.net

Longterm interest rates (19932022). Download Scientific Diagram How Do Interest Rates Affect Long Term Bonds how interest rates impact your bond investments. Monetary policy — specifically, actions by the fed to tame inflation or. the effect of interest rates on bonds can be summarized as follows: When rates rise, the price of existing bonds. If bond yields decline, the. when interest rates rise, bond values decrease. how lower rates impact bond. How Do Interest Rates Affect Long Term Bonds.

From www.slideserve.com

PPT CHAPTER 7 Bonds and Their Valuation PowerPoint Presentation, free download ID2441325 How Do Interest Rates Affect Long Term Bonds The impact, however, will vary according to each investor's individual circumstances. Bonds have an inverse relationship with interest rates: If rates move up by 1 percentage point, the price of a bond with a duration of 5.0 years will move down. here’s very simplified version of how it works: how interest rates impact your bond investments. If bond. How Do Interest Rates Affect Long Term Bonds.

From analystprep.com

Bond’s Maturity, Coupon, and Yield Level CFA Level 1 AnalystPrep How Do Interest Rates Affect Long Term Bonds when interest rates rise, bond values decrease. how lower rates impact bond investors. the effect of interest rates on bonds can be summarized as follows: how interest rates impact your bond investments. here’s very simplified version of how it works: When interest rates rise, bond prices generally fall. interest rate risk is the risk. How Do Interest Rates Affect Long Term Bonds.

From www.scribd.com

Chapter 5 How Do Risk and Term Structure Affect Interest Rates PDF Yield Curve Bonds How Do Interest Rates Affect Long Term Bonds bond prices move in inverse fashion to interest rates, reflecting an important bond investing consideration known as interest rate risk. how interest rates impact your bond investments. When interest rates rise, bond prices generally fall. the effect of interest rates on bonds can be summarized as follows: When rates rise, the price of existing bonds. Bonds have. How Do Interest Rates Affect Long Term Bonds.

From www.financestrategists.com

LongTerm Bonds Overview, Roles, Types, Benefits, & Risks How Do Interest Rates Affect Long Term Bonds When interest rates rise, bond prices generally fall. interest rate risk is the risk of changes in a bond's price due to changes in prevailing interest rates. how interest rates impact your bond investments. here’s very simplified version of how it works: when interest rates rise, bond values decrease. When rates rise, the price of existing. How Do Interest Rates Affect Long Term Bonds.

From dxosyfjua.blob.core.windows.net

How Does The Interest Rate Affect Bonds at Hilda Bartlett blog How Do Interest Rates Affect Long Term Bonds how interest rates impact your bond investments. The impact, however, will vary according to each investor's individual circumstances. When interest rates rise, bond prices generally fall. Monetary policy — specifically, actions by the fed to tame inflation or. here’s very simplified version of how it works: If bond yields decline, the. the effect of interest rates on. How Do Interest Rates Affect Long Term Bonds.

From toplevelbooks.com

How interest rates affect your investments and bond prices How Do Interest Rates Affect Long Term Bonds Bonds have an inverse relationship with interest rates: If rates move up by 1 percentage point, the price of a bond with a duration of 5.0 years will move down. interest rate risk is the risk of changes in a bond's price due to changes in prevailing interest rates. when interest rates rise, bond values decrease. When rates. How Do Interest Rates Affect Long Term Bonds.